Becoming a first-time homebuyer is an exciting milestone in anyone’s life. However, it can also be a daunting and overwhelming process. With so many factors to consider and decisions to make, it’s important to approach the homebuying journey with confidence and knowledge. In this comprehensive guide, we will provide you with 10 essential tips to help first-time homebuyers navigate the process successfully.

1. Determine Your Budget

Before you start searching for your dream home, it’s crucial to establish a realistic budget. Take into account your current financial situation, including your income, expenses, and any debts you may have. Consider consulting with a financial advisor or mortgage specialist to determine how much you can afford to borrow and how much your monthly mortgage payments will be.

2. Save for a Down Payment

Saving for a down payment is a significant aspect of the homebuying process. While the traditional down payment is 20% of the home’s purchase price, there are options available for smaller down payments. However, keep in mind that a larger down payment will result in a lower monthly mortgage payment.

3. Research Mortgage Options

Take the time to research different mortgage options and choose the one that best suits your needs. Consider factors such as interest rates, loan terms, and eligibility requirements. It’s advisable to get pre-approved for a mortgage before starting your home search, as this will give you a clear understanding of your budget and increase your chances of securing your dream home.

4. Understand Additional Costs

In addition to your mortgage payments, there are additional costs associated with buying a home. These include closing costs, property taxes, homeowner’s insurance, and maintenance expenses. It’s essential to factor these costs into your budget to ensure you can comfortably afford your new home.

5. Research Neighborhoods

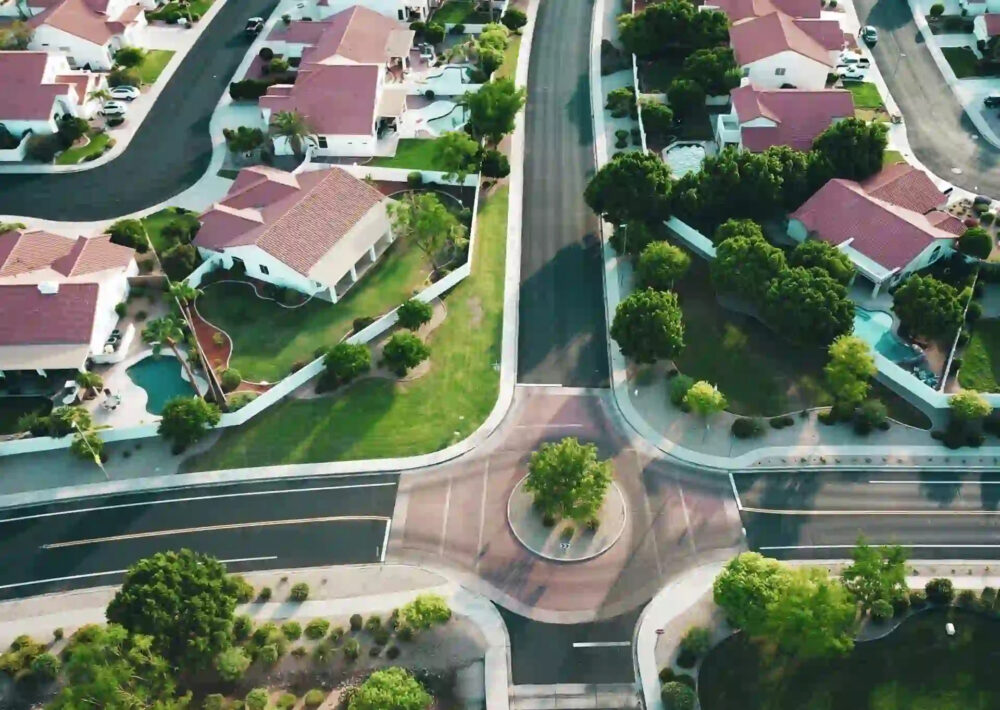

When searching for a home, pay close attention to the neighborhoods you’re interested in. Research factors such as safety, proximity to amenities, schools, and transportation options. Visiting the neighborhoods and speaking with local residents can also provide valuable insights.

6. Work with a Real Estate Agent

Partnering with an experienced real estate agent can make the homebuying process much smoother. An agent can help you navigate the market, find suitable properties, negotiate offers, and handle the paperwork. Look for an agent who specializes in first-time homebuyers and has a good understanding of the local market.

7. Attend Open Houses

Attending open houses is an excellent way to get a feel for the homes in your desired neighborhoods. Take the opportunity to ask questions, inspect the property, and envision yourself living there. Open houses can also give you a sense of the current market conditions and help you refine your preferences.

8. Get a Home Inspection

Before finalizing the purchase, it’s crucial to get a professional home inspection. This will reveal any potential issues or defects with the property, allowing you to make an informed decision. If significant problems are identified, you may negotiate repairs or even reconsider your offer.

9. Review the Purchase Agreement

Carefully review the purchase agreement with your real estate agent and, if necessary, a lawyer. Ensure that all the agreed-upon terms are included and that you understand your rights and responsibilities as a buyer. Don’t hesitate to ask questions and seek clarification on any points that are unclear.

10. Prepare for the Closing Process

The closing process is the final step in purchasing a home. It involves signing the necessary paperwork, transferring funds, and officially taking ownership of the property. Prepare all the required documents in advance, including identification, proof of insurance, and any additional paperwork requested by your lender or attorney.

Purchasing your first home is an exciting journey filled with challenges and rewards. By following these 10 tips, you’ll be well-equipped to make informed decisions, navigate the market, and find the perfect place to call home. Remember, patience and perseverance are key, and with the right guidance, you’ll soon be unlocking the door to your new home.