Are you considering investing in a property? Conducting due diligence is a crucial step in the process that can save you from making costly mistakes. In this blog post, we will guide you through the essential steps to conduct due diligence on a potential investment property.

Step 1: Research the Location

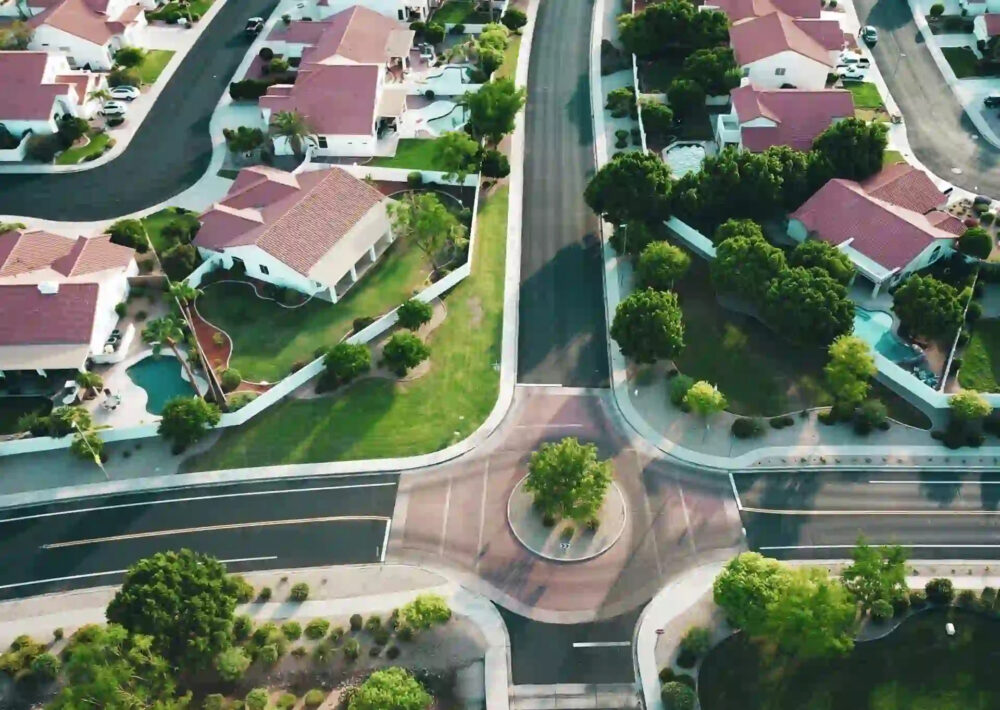

Before diving into the specifics of the property, it’s important to research the location thoroughly. Look for information on the local real estate market, crime rates, schools, amenities, and future development plans. Understanding the location’s potential will help you evaluate the property’s long-term prospects.

Step 2: Evaluate the Property’s Condition

Inspecting the property’s condition is vital to assess its value accurately. Hire a professional home inspector to examine the property thoroughly, including the foundation, roof, plumbing, electrical systems, and overall structural integrity. Identifying potential issues early on will help you negotiate a fair price and plan for any necessary repairs or renovations.

Step 3: Analyze the Financials

To make an informed investment decision, you need to analyze the property’s financials. This includes gathering information on its current and potential rental income, vacancy rates, property taxes, insurance costs, and any outstanding liens or debts. Calculate the property’s potential return on investment (ROI) to ensure it aligns with your financial goals.

Step 4: Review Legal Documents

Reviewing the property’s legal documents is crucial to identify any potential red flags. Request copies of the title deed, lease agreements, zoning regulations, and any pending or past legal disputes. Consult with a real estate attorney to ensure everything is in order and to address any concerns before proceeding with the investment.

Step 5: Assess Market Demand

Understanding the market demand for rental properties in the area is essential to ensure a steady stream of income. Research the local rental market, vacancy rates, and rental prices for similar properties. Evaluate the potential for future growth and demand based on population trends, job opportunities, and economic indicators.

Step 6: Consider the Exit Strategy

Always have an exit strategy in mind when investing in a property. Evaluate the potential for selling the property in the future, should the need arise. Research the market trends, property appreciation rates, and demand for similar properties to assess the property’s long-term value and potential resale opportunities.

Step 7: Seek Professional Advice

While conducting due diligence, it’s beneficial to seek professional advice. Consult with a real estate agent, property manager, or financial advisor who specializes in investment properties. Their expertise and insights can provide valuable guidance and help you make informed decisions.

Remember, conducting due diligence is a time-consuming process, but it is a crucial step in making a successful investment. By thoroughly researching the location, evaluating the property’s condition and financials, reviewing legal documents, assessing market demand, considering the exit strategy, and seeking professional advice, you can minimize risks and maximize your chances of a profitable investment.

Investing in a property can be a rewarding venture, and by following these steps, you’ll be well-equipped to make an informed decision. Good luck with your due diligence, and may your investment journey be prosperous!