Investing in real estate can be a lucrative venture, and one strategy that many investors employ is to seek out distressed properties. Distressed properties are those that are in poor condition or facing financial difficulties, and they can present excellent investment opportunities for those willing to put in the work. In this article, we will discuss how to identify distressed properties and take advantage of the potential they offer.

Research Local Market Conditions

Before you start your search for distressed properties, it’s essential to research the local market conditions. Understanding the current state of the real estate market in your target area will give you valuable insights into the demand, supply, and pricing trends. Look for areas where property values have declined, vacancy rates are high, or foreclosure rates are increasing. These indicators can point you in the direction of potential distressed properties.

Network with Real Estate Professionals

Building a network of real estate professionals is crucial when it comes to finding distressed properties. Connect with real estate agents, property managers, and local investors who have experience in this niche. Attend industry events, join online forums, and participate in networking groups to expand your reach. These connections can provide you with valuable leads and insights into distressed properties that may not be readily available to the general public.

Keep an Eye on Public Notices

Public notices, such as foreclosure listings and tax lien sales, can be a goldmine for identifying distressed properties. Check local newspapers, government websites, and online platforms that specialize in listing these types of properties. Look for properties with pending foreclosures, tax liens, or auctions. These properties often offer significant discounts, as the owners are typically motivated to sell quickly.

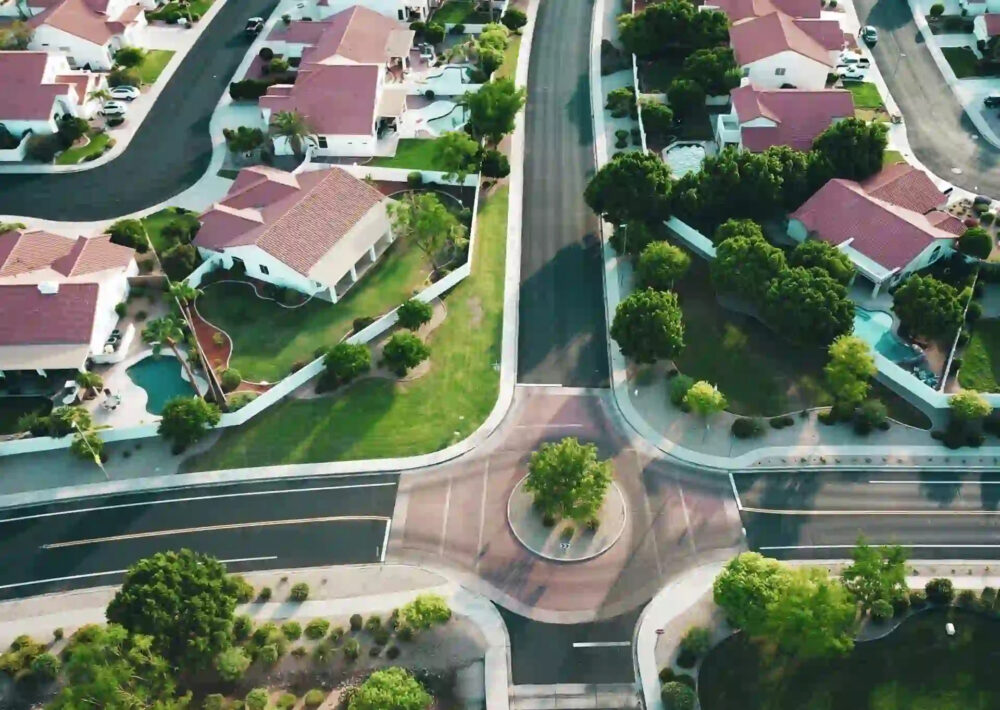

Drive Through Target Neighborhoods

Sometimes the best way to spot distressed properties is by getting out and exploring target neighborhoods. Take a drive or walk around areas that interest you, paying attention to signs of neglect, such as overgrown lawns, boarded-up windows, or general disrepair. These can be indicators that a property is distressed and potentially available for investment.

Utilize Online Resources

In today’s digital age, there are numerous online resources that can help you identify distressed properties. Websites like Zillow, Trulia, and Realtor.com allow you to search for properties based on specific criteria, including condition and pricing. Additionally, there are specialized platforms like Auction.com and RealtyTrac that focus on distressed properties. These websites can provide you with detailed information on properties in various stages of distress, such as pre-foreclosure, short sale, or bank-owned.

Conduct Due Diligence

Once you have identified a distressed property that piques your interest, it’s crucial to conduct thorough due diligence before making an offer. Hire a professional home inspector to assess the property’s condition, including any structural, electrical, or plumbing issues. Research the property’s history, including liens, back taxes, and outstanding debts. Understanding the full picture will help you determine the potential costs and risks associated with the investment.

Negotiate Smartly

When it comes to distressed properties, successful investors know how to negotiate smartly. Sellers of distressed properties are often motivated to sell quickly, which can work in your favor. However, it’s essential to approach negotiations with a realistic offer based on the property’s condition and market value. Understand the seller’s circumstances, and be prepared to justify your offer with evidence and comparable sales data.

Conclusion

Identifying distressed properties for investment opportunities requires thorough research, networking, and due diligence. By staying informed about local market conditions, building a network of real estate professionals, utilizing online resources, and conducting proper due diligence, you can uncover hidden gems that have the potential to provide excellent returns on investment. Remember, investing in distressed properties can be a rewarding strategy, but it requires patience, perseverance, and a willingness to take calculated risks. Happy hunting!