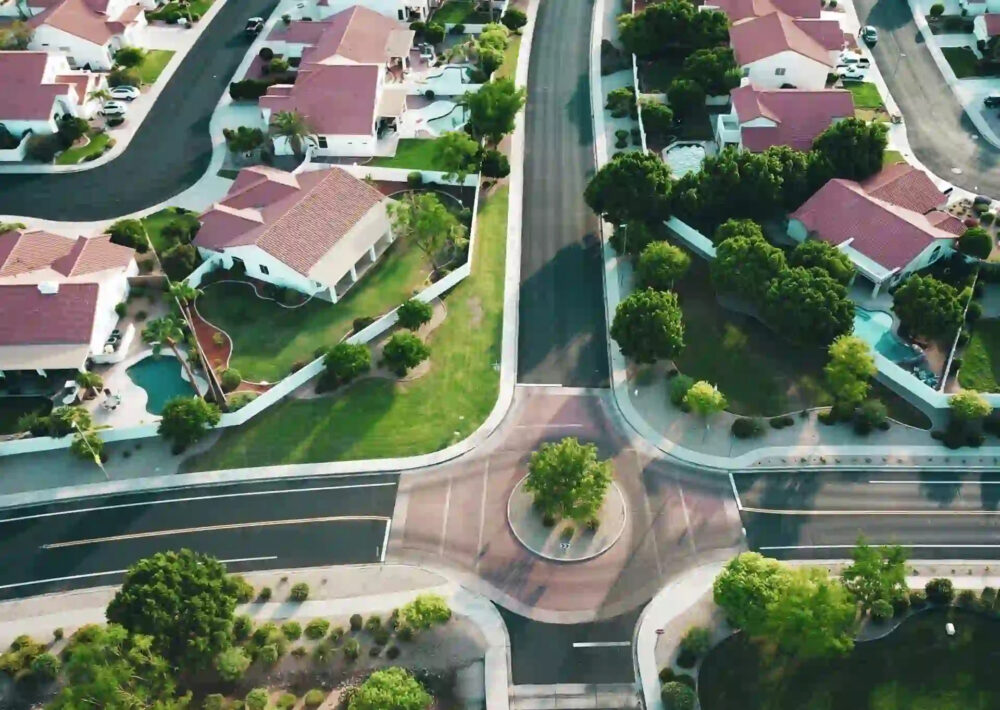

Investing in real estate has long been a popular choice for individuals looking to diversify their portfolios and generate passive income. Traditionally, investing in real estate required substantial capital and a deep understanding of the market. However, with the advent of technology, a new form of real estate investment has emerged - crowdfunding.

Real estate crowdfunding platforms have revolutionized the way people invest in properties. Through these platforms, individuals can pool their resources with other investors to collectively fund real estate projects. This democratization of real estate investing has opened up a world of opportunities for both seasoned investors and newcomers alike. Here are some of the benefits of investing in real estate crowdfunding:

1. Access to a Diverse Range of Properties

One of the significant advantages of real estate crowdfunding is the access it provides to a diverse range of properties. In traditional real estate investing, individuals often face limitations due to geographical constraints or financial barriers. With real estate crowdfunding, investors can choose from a variety of properties located in different regions, asset classes, and risk levels. This diversification helps spread the investment risk and potentially increases returns.

2. Lower Barrier to Entry

Historically, real estate investments required a substantial amount of capital, making it inaccessible to many individuals. Real estate crowdfunding platforms have significantly lowered the barrier to entry by allowing investors to contribute smaller amounts of capital. This means that even those with limited funds can participate in real estate investing and benefit from the potential returns.

3. Increased Liquidity

Traditional real estate investments are often illiquid, meaning that it can be challenging to convert the investment into cash quickly. Real estate crowdfunding platforms, on the other hand, offer increased liquidity. Investors can typically buy and sell their shares in a property through the platform’s secondary market. This liquidity provides investors with more flexibility and control over their investments, allowing them to respond to changing market conditions more effectively.

4. Passive Income Generation

Real estate crowdfunding offers investors the opportunity to generate passive income. By investing in income-generating properties, such as rental properties or commercial buildings, investors can earn regular cash flow in the form of rental income or profit distributions. This passive income stream can provide financial stability and supplement other sources of income.

5. Professional Management

Managing a real estate investment can be time-consuming and require specialized knowledge. Real estate crowdfunding platforms often partner with experienced property managers who handle the day-to-day operations of the investment. This professional management allows investors to benefit from the expertise of industry professionals and frees up their time for other pursuits.

6. Mitigated Risk

Investing in real estate, like any investment, comes with its fair share of risks. However, real estate crowdfunding can help mitigate some of these risks through diversification and due diligence. By investing in multiple properties across different locations and asset classes, investors can spread their risk and potentially offset any underperforming investments with better-performing ones. Additionally, crowdfunding platforms often conduct thorough due diligence on the properties and sponsors before listing them on their platforms, providing an extra layer of protection for investors.

In conclusion, real estate crowdfunding offers a range of benefits for investors looking to enter the real estate market or diversify their existing portfolios. From access to a diverse range of properties and lower barriers to entry to increased liquidity and passive income generation, the advantages are clear. However, as with any investment, it’s essential to conduct thorough research and due diligence before committing funds. Real estate crowdfunding has the potential to be a powerful tool for wealth creation, but investors should approach it with careful consideration and a long-term investment mindset.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Investing in real estate crowdfunding carries risks, and investors should consult with a financial advisor before making any investment decisions.