Artificial Intelligence (AI) has been making significant waves in various industries, and the financial services sector is no exception. With its ability to analyze vast amounts of data at unparalleled speeds, AI is revolutionizing the way financial institutions operate, make decisions, and interact with customers. In this blog post, we’ll delve into the multifaceted role of AI in financial services, exploring its impact on customer experience, risk management, fraud detection, and more.

Enhancing Customer Experience

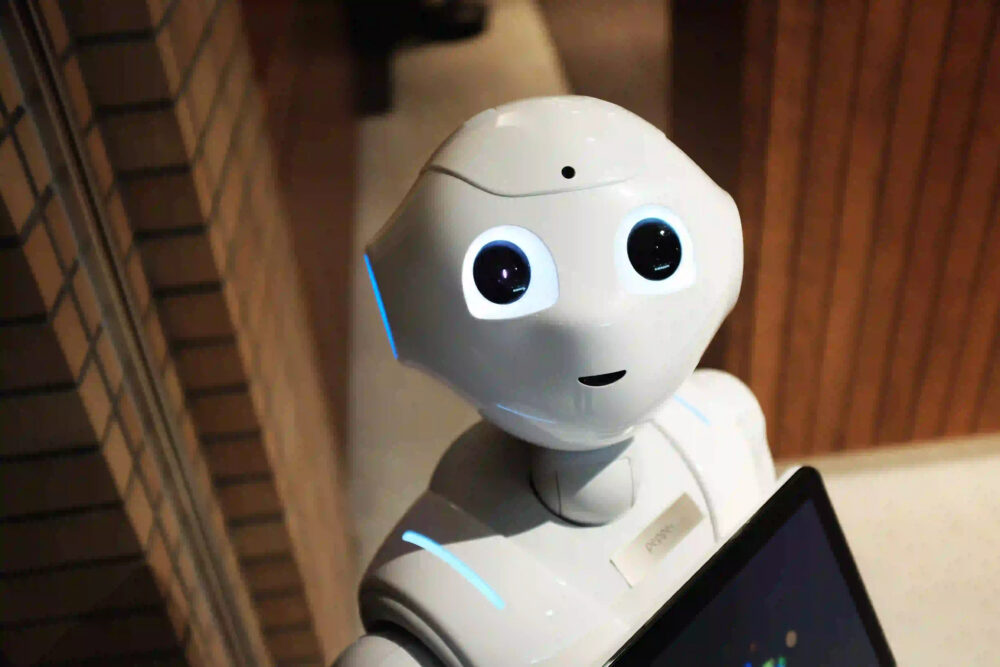

One of the most noticeable impacts of AI in financial services is its role in enhancing customer experience. Through chatbots and virtual assistants, financial institutions can provide personalized, round-the-clock customer support. These AI-driven interfaces can answer queries, provide account information, and even offer financial advice, all in real-time. By leveraging natural language processing and machine learning algorithms, these virtual assistants can understand and respond to customer queries with a level of efficiency and accuracy that was previously unattainable.

Furthermore, AI enables financial institutions to offer personalized product recommendations and tailored financial solutions based on individual customer data. Through predictive analytics, AI algorithms can analyze spending patterns, investment preferences, and life events to offer personalized financial advice, ultimately improving the overall customer experience.

Risk Management and Compliance

AI’s role in risk management and compliance within the financial services industry cannot be overstated. By analyzing historical data and identifying patterns, AI algorithms can assess and mitigate various types of risks, including credit, market, and operational risks. These algorithms can detect anomalies and potential risks in real-time, enabling financial institutions to proactively manage and mitigate potential threats to their operations.

Moreover, AI plays a pivotal role in regulatory compliance by automating the process of monitoring and ensuring adherence to complex and ever-evolving regulatory requirements. Through natural language processing and deep learning, AI systems can analyze regulatory documents, identify relevant information, and ensure that financial institutions are compliant with the latest regulations, thus reducing the risk of non-compliance penalties.

Fraud Detection and Prevention

The financial services industry has long been a target for fraudulent activities, making fraud detection and prevention a top priority for financial institutions. AI has emerged as a powerful tool in this regard, leveraging advanced algorithms to detect fraudulent activities in real-time. By analyzing transaction patterns, customer behavior, and other relevant data points, AI algorithms can identify anomalies and flag potentially fraudulent transactions before they cause significant harm.

Furthermore, AI-powered systems can continuously learn and adapt to new fraud patterns, ensuring that financial institutions stay ahead of evolving threats. By leveraging machine learning and anomaly detection techniques, AI contributes to a proactive approach to fraud prevention, ultimately safeguarding the financial interests of both institutions and their customers.

Investment and Trading

In the realm of investment and trading, AI is transforming the landscape by enabling sophisticated predictive analytics and algorithmic trading. AI algorithms can analyze vast amounts of financial data, news, and market trends to identify potential investment opportunities and optimize trading strategies. Through machine learning, AI systems can continuously learn from market behaviors and adjust investment strategies accordingly, potentially yielding higher returns and minimizing risks.

Moreover, AI-driven robo-advisors are gaining popularity, offering automated investment advice and portfolio management services based on individual risk profiles and investment goals. These robo-advisors can provide personalized investment recommendations and rebalance portfolios in real-time, offering a cost-effective and efficient alternative to traditional wealth management services.

Conclusion

The role of AI in financial services is multifaceted, encompassing various aspects of customer experience, risk management, fraud detection, and investment strategies. As AI continues to evolve, financial institutions will increasingly rely on its capabilities to streamline operations, improve decision-making, and provide innovative financial solutions to their customers. While the integration of AI presents new challenges and considerations, its potential to drive efficiency, mitigate risks, and enhance customer experiences makes it a transformative force in the financial services industry.

In conclusion, the symbiotic relationship between AI and financial services is poised to reshape the industry, ushering in a new era of innovation and efficiency. As financial institutions embrace the capabilities of AI, they will be better equipped to navigate the complexities of the modern financial landscape, ultimately benefiting both institutions and their customers. The future of AI in financial services is undoubtedly promising, and its continued evolution will undoubtedly shape the industry’s trajectory for years to come.