Cryptocurrency mining has become a buzzword in the world of digital finance, but what exactly is it, and how does it work? In this comprehensive guide, we’ll delve into the intricacies of cryptocurrency mining, exploring its purpose, mechanics, and impact on the digital economy.

What is Cryptocurrency Mining?

At its core, cryptocurrency mining is the process of validating transactions and adding them to a blockchain ledger. This process involves solving complex mathematical puzzles using computational power, with miners competing to be the first to find the correct solution.

How Does Cryptocurrency Mining Work?

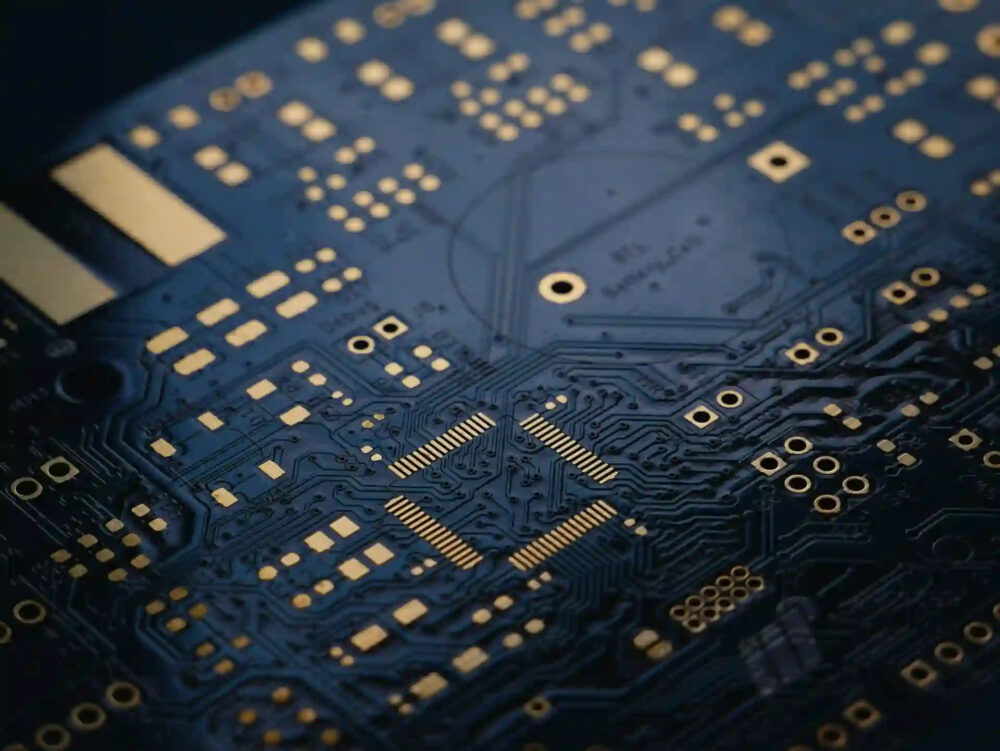

Cryptocurrency mining relies on a decentralized network of computers, known as nodes, to verify and record transactions. Miners use specialized hardware, such as ASICs (Application-Specific Integrated Circuits) for Bitcoin mining or GPUs (Graphics Processing Units) for Ethereum mining, to perform the necessary computations.

When a miner successfully solves a cryptographic puzzle, they create a new block containing a batch of verified transactions. This block is then added to the blockchain, and the miner is rewarded with newly minted cryptocurrency as well as transaction fees.

The Role of Electricity in Mining

One of the defining characteristics of cryptocurrency mining is its voracious appetite for electricity. The computational power required to solve cryptographic puzzles consumes significant amounts of energy, leading to concerns about the environmental impact of mining operations.

Mining profitability depends on several factors, including the cost of electricity and the efficiency of mining hardware. Miners often seek out locations with cheap electricity, such as regions with abundant renewable energy sources or areas with subsidized electricity rates, to maximize their profit margins.

Popular Mining Algorithms

Different cryptocurrencies use different consensus algorithms to secure their networks and validate transactions. Some of the most common mining algorithms include:

- Proof of Work (PoW): Used by Bitcoin and many other cryptocurrencies, PoW requires miners to solve complex mathematical puzzles to validate transactions and create new blocks.

- Proof of Stake (PoS): In a PoS system, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

- Proof of Authority (PoA): In a PoA system, block validators are selected based on their reputation or authority within the network.

The Evolution of Mining

Since the early days of Bitcoin mining, the industry has undergone significant evolution and innovation. As cryptocurrencies have gained mainstream adoption, mining has become increasingly specialized and industrialized, with large-scale mining operations dominating the landscape.

In addition to traditional mining farms, there has been a rise in alternative mining methods, such as cloud mining and mining pools, which allow individuals to pool their resources and share mining rewards.

Environmental Considerations

The environmental impact of cryptocurrency mining has sparked debate and controversy in recent years. Critics argue that the energy-intensive nature of mining contributes to carbon emissions and exacerbates climate change.

In response to these concerns, some cryptocurrency projects are exploring alternative consensus mechanisms that are less energy-intensive, such as Proof of Stake or Proof of Authority. Additionally, efforts are underway to develop more energy-efficient mining hardware and to locate mining operations in regions with access to renewable energy sources.

Conclusion

Cryptocurrency mining plays a crucial role in the operation and security of blockchain networks, serving as the backbone of decentralized finance. While mining can be lucrative for those with access to cheap electricity and specialized hardware, it also raises important questions about energy consumption and environmental sustainability.

As the cryptocurrency landscape continues to evolve, finding a balance between profitability and environmental responsibility will be key to ensuring the long-term viability of mining operations. By understanding the mechanics and implications of cryptocurrency mining, investors, policymakers, and enthusiasts can make informed decisions about its role in the digital economy.